Business funding options

Guide: Choosing the Best Source of Small Business Funding

Lenders or Investors? Let’s Take a Deeper Look

You (arguably) don’t need money to make money. Business funding is probably near the bottom of your business to-do list. But the cold, hard truth is this: You somehow need money to start or grow your business – even if you’re bootstrapping; not only to pay the bills, but you also need it to promote your business.

The thing is, if your don’t have the resources to keep your business afloat, it’s likely doomed for failure. If you’re in the red constantly, it’s only a matter of time until the doors soon close. Any of these scenarios require a cash influx in order to start a business and keep it going.

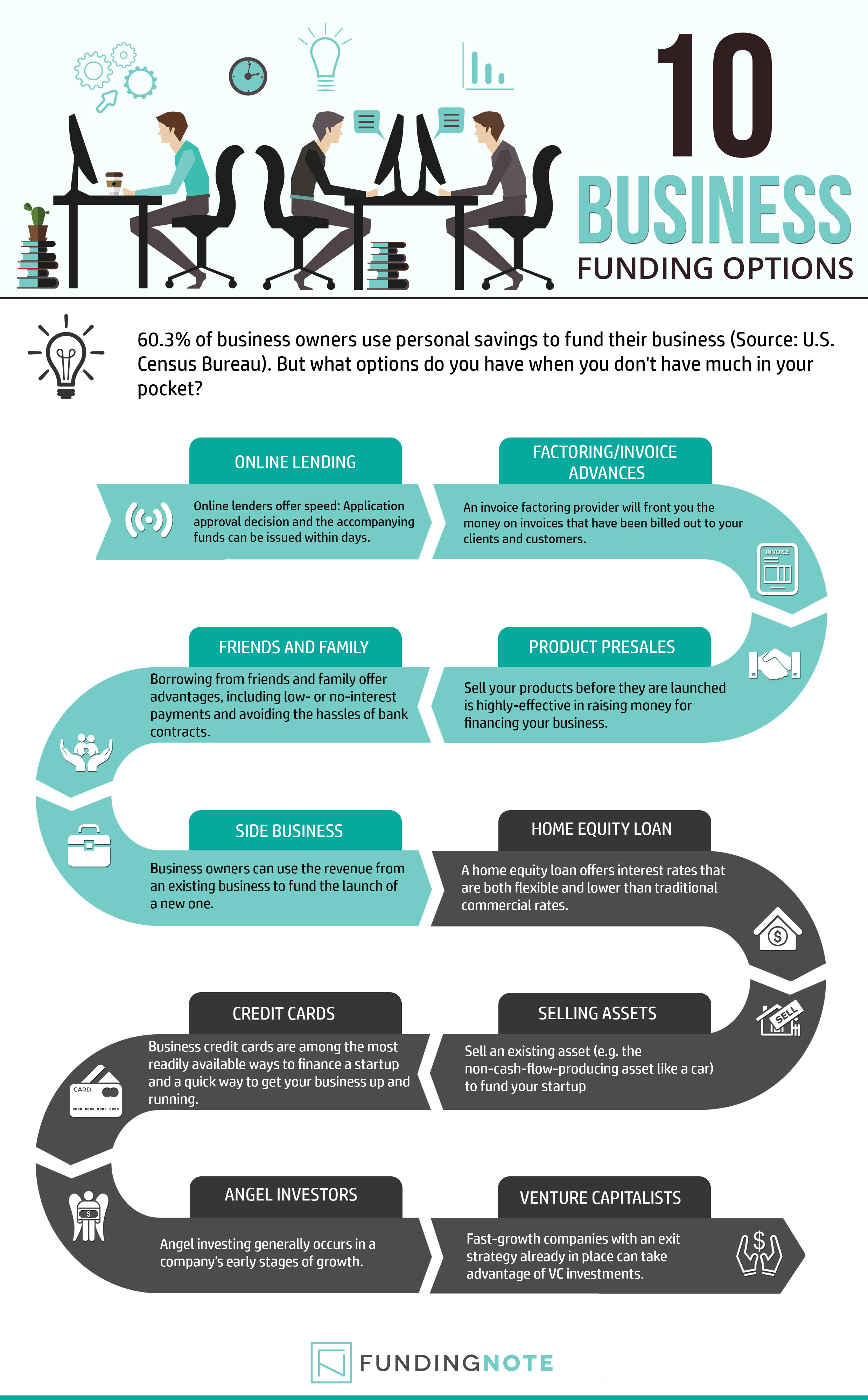

Top 10 Business Funding Options

Here are ten most popular funding ideas that you may want to consider (click to enlarge.)

Share this Image On Your Site

What Options Do I Have When I Don’t Have The Resources and Assets?

As you can see from the above infographic, category-wise, there’s only two ways to get your hands on that money if you don’t have friends or family to turn to or assets to make use of:

- Seek out a lender (debt financing).

- Find an investor (equity financing) to swoop in and save the day.

Neither option is as easy as it might seem. Banks and private lenders aren’t as loose with their loan agreements as they were last year. Same goes for venture capitalists. With constant postulation from financial experts claiming we’re doomed for another recession and the current failure of the Fed’s quantitative easing program, the wealthy are being even more careful about what they stick their money into.

I’m not saying it’s impossible to get more cash for your business. Far from it. But unless you have the next billion dollar tech startup and billionaire investors lining up at your door with low equity stake offers, weighing the pros and cons of each type of financing has never been more important for the future of your business.

Lenders: Debt Financing

Anytime you borrow money and promise to pay it back with interest, you’re taking on debt. While banks, family and friends have traditionally been the most common type of debt financing, there are a number of private lenders out there these days too. With all the online SMB lenders like Kabbage cropping up every day, it’s never been easier to secure on-the-spot financing for your small business needs. It’s much easier to secure business funding from a lender than it is an investor.

There are advantages and disadvantages to borrowing cash from institutions and private lenders.

Advantages:

- The lender has no stake in your business, meaning you retain full control over how its run.

- After you repay the loan, you have no further obligation to them, until and if you need their help again in the future.

- Interest paid is tax deductible, so you don’t lose every dime you pay out above and beyond the principal.

- Terms are fixed and predictable, making payments easy to plan and allocate funds for.

- With all the available options for SMB lenders, you’re virtually guaranteed acceptance if you have any ability to repay – even if you have to secure high risk debt.

Disadvantages:

- You have to pay back every penny you owe, meaning you’re banking heavily on your business’s success to pull you out of debt.

- You’re at the mercy of several factors out of your control such as consumer interests in your products, the economy as a whole, and many other potentials.

- Payments are made on a schedule. Failure to stick to that schedule means big penalties such as higher interest rates, the danger of having the loan called back, and even repossession of your business and its assets to cover the outstanding balance.

- All these issues can stifle the growth of your business if you’re not able to stick to the payment terms or if you’re still riding the line between black and red every month just to keep afloat.

- Lenders will typically require you to guarantee the loan with your personal assets, regardless if you’ve established an LLC or other separate business entity. This goes triple if you need a high risk lender to bail you out of trouble.

Check out the SBA Loan Programs site if you think debt financing is the route you want to go. Their guaranteed loan program makes it easier for SMBs to secure business funding in most situations. They can’t help all businesses, but if you meet their criteria this is a much safer bet to hedge than private high risk lending companies.

Investors: Equity Financing

Whether an angel falls from the heavens to offer you wads of cash, or you find yourself seeking help from big-money venture capitalists, à la Shark Tank, this option offers different advantages, especially when it comes to growing a company. In exchange for a stake (ie., partial ownership) in your company, an investor gives you the cash infusion you need to launch, grow or save your company from its financial woes. Equity investors are harder to find unless you have a trending product or something that’s innovative and offers long term ROI to the investor.

Advantages:

- The investors take the brunt of the risk. If the company loses big or folds completely, you don’t have to pay them back their investment cash.

- The investor is financing in exchange for a stake, not loaning you the money. Therefore, there are no loan payments to allocate for, leaving more potential cash on the table to further grow the business and/or take a personal salary.

- Most investors are visionaries and may understand the long term goals you’re striving for better than a stuffy lender would.

- Once you establish a great relationship with them, your equity financier will be more open to future financing as well as giving you access to other lenders that travel in their circles.

- There’s no risk of losing your personal assets if things go south.

Disadvantages:

- Unless you have a one-in-a-million idea with profit potential to back your play, you’re going to have to give up a substantial stake in your business in exchange for their money. Consider 33% a gift, as many will want 49 – 51% and higher.

- Since they own a portion (of what was once entirely your company), investors expect to have a say in how the business is run, leading to disagreements between each of you, and likely compromises on your part.

- With a loan, the relationship ends with the repayment of the loan. With a lender, the only way out is to buy them out. The buyout terms will generally leave you with much less than you started with if your business still isn’t doing well.

- Finding equity investors to fund your business is difficult. Many have gate-keepers and/or are very industry-specific when it comes to where their money is going.

- You have to share your profits with them. Not to mention: Interest paid is tax deductible; profit dividend payouts are not.

Which Business Funding Method Should You Choose?

Sadly, most small businesses often don’t have a choice in the type of business funding they can choose. For the purposes of the article, venture capital and angel investors have been lumped into the same category. Not because there aren’t any differences, but because they’re big fish and out of reach for most small businesses. If you only have a small pond to offer them, they don’t want to swim with you!

VC Funding?

VC’s are looking for businesses that have global reach. They’re also interested in growing companies, with products and services that have huge market viability both now, and in the foreseeable future. Or, you’ll need a niche type product that catches the fancy of the investor or investor group such as cryogenics, space travel or moon habitation units (yes, seriously, didn’t you hear water has been discovered on Mars?).

The low-down on VC investors:

Venture capitalists aren’t a bank. If you’re looking for a loan to cover some losses, buy new equipment, or hire an employee or two, you’re wasting your time. If you have a big idea, that needs big cash, and offers an even bigger return, start pounding the pavement and you’ll likely find a VC willing to fund your venture – provided you’re not delusional and your business idea is pure bunk!

Angel Funding?

Angel investors may be more likely to invest than VCs, but most Silicon Valley types like Tim Ferriss are only interested to invest hundreds of thousands in exchange for an equal or majority stake in the company. This is very beneficial for startups looking to secure a lasting relationship with an actual person, as opposed to the entities that often represent venture capitalists. But it’s still difficult for the majority of small businesses to meet an angel’s criteria.

The low-down on Angel investors:

Angels may be willing to fund smaller ventures, but not if you’re running a local business, a business with low profit margins, or working in an industry with low growth potential. Angels want to make money too, many are millionaires, but they don’t have millions to invest in one single opportunity. They’re also more personality-focused. Looking to do business with people who align with their values in the areas of ethics, risk aversion and growth strategies.

Debt Lenders?

Debt lenders are easier to find and much easier to get a sit down meeting with. Online SMB lenders don’t even require any sit down meeting at all. The interest you pay over the lifetime of a loan will be in direct relation to your ability to repay the loan you’re asking for – ie., how much of a risk you represent.

A Note on Crowdfunding

Crowdfunding is a smart business funding idea for startups. However, the time involved to set up a good campaign, not to mention the outreach involved, makes this improbable for saving or growing a business, and you might not get very much in the end if your business model doesn’t resonate with the “crowd”.

In most cases, startup owners still need to secure a mixture of crowdfunds, loans and equity investors in order to get their idea off the ground.

The Bottom Line

The answer should be obvious if you don’t have friends or family to borrow from. If heavy, heavy growth isn’t in your conceivable future, VCs and angels aren’t the way to go and your best option is to find a lender that offers the best terms possible including provisions to pay back the loan early without penalty and a fixed interest rate to protect you from economic upheaval.

So, there you go – our business funding guide for budding entrepreneurs and business owners. If you have any questions or feedback, please contact us at info